The Fort Bend County Municipal Utility District No. 128 will hold a public hearing on a proposed tax rate for the tax year 2018 on Monday, September 24, 2018 at 8:15 a.m. at the offices of The Muller Law Group, PLLC,202 Century Square Boulevard, Sugar Land, Texas 77478. Your individual taxes may increase or decrease, depending on the change in the taxable value of your property in relation to the change in taxable value on all other property and the tax rate that is adopted.

FOR the proposal: M. Cabiro, R. Bowen, H. Millis, J. Hogan & T. VanHorn

AGAINST the proposal: (none)

PRESENT and not voting: (none)

ABSENT: (none)

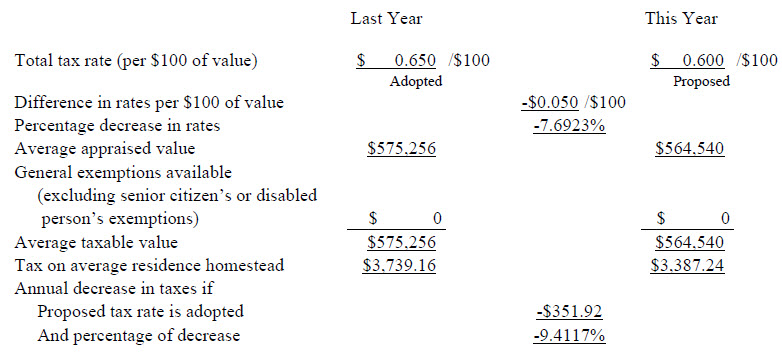

The following table compares taxes on the average residence homestead in this taxing unit last year to taxes proposed on the average residence homestead this year.

Notice of TaxPayers’ Right to Rollback Election

If taxes on the average residence homestead increase by more than eight percent, the qualified voters of the district by petition may require that an election be held to determine whether to reduce the operation and maintenance tax rate to the rollback tax rate under Section 49.236(d), Water Code.

Questions or comments regarding this notice can be directed to Esther Buentello Flores at the tax office at (281) 499-1223.